The article to be discussed: this one.

Wall St rebounds from selloff; indexes up for the week

Technology stocks ranked among the day's biggest gainers. Google led the rally. Its stock jumped 4.2 percent to USD 605.11 a day after the No. 1 Internet search company reported second-quarter results that beat investors' expectations.

Numbers and percentages and stuff! This is an article for the crème de la crème, the real investor types!!!

The article reads like a laundry list of statistics for the: S&P 500, Google, Facebook, Dow Jones, Nasdaq, CBOE volatility index, Russel 2000...

Sorry, I just nodded off there for a moment.

To save you, dear reader from having to read the article, here is a Q&A with... myself.

What does this article tell me?

The stock market fell on Thursday, before rising on Friday. Some stocks did particularly well, other stocks fell precipitously. World events happened, but failed to affect the stock market in any lasting way. Depending on which collection of stocks an investor had picked on Monday, that investor might have gained or lost money on Friday.

So, basically this article doesn't tell me anything.

What do you mean, doesn't tell you anything? By reading this article, you learned that:

Market participants kept geopolitical news in focus. US President Barack Obama demanded that Russia stop supporting separatists in eastern Ukraine a day after the downing of a Malaysian airline by a surface-to-air missile, which he said was fired from rebel territory. The incident raised the prospect of more US sanctions on Moscow.

Investors also remained cautious after Israel warned on Friday that it could "significantly widen" a Gaza land offensive.

What the heck does that mean?

Well, it means that people who invest also read the news. It also means that to save time, the writer of this article copied the major weekly headlines and added a little market spin. Here: I'll show you how it's done.

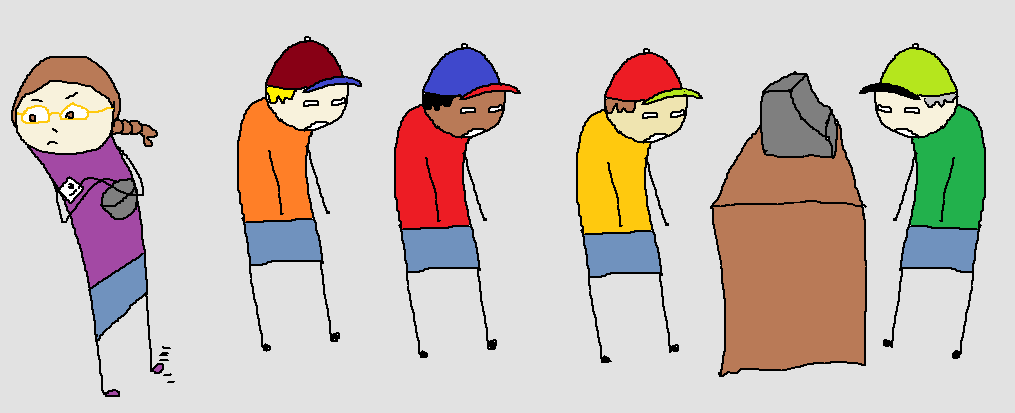

Market participants kept geopolitical news in focus...

|

| Gosh, golly. It's hard to keep focus, the little tyke is moving so quickly! |

Investors remain cautious after...

|

| I'd be cautious, too, but only if I was alone in a room with him. |

I read market news to help me invest. What benefit does this article have for me, the investor?

Do you also have a time machine? Because if you did, this article would tell you that you should, on July 14th 2014, definitely buy: Google, Facebook and Honeywell International. That same day, you should sell any of your General Electric Shares.

I don't have a time machine, obviously.

Oh... That's problematic.

Well, have no fear! The article also gives you some rock-solid guidance for the future:

"It seems counter-intuitive, given the ruthlessness with which the market sold off yesterday, but in the broader context, the markets are generating a lot of attractive themes," said Peter Kenny, chief market strategist at Clearpool Group in New York.

"We have an economy that is expanding," he added. "We have many data points that support that narrative. We are in the middle of earnings season, and earnings season has given investors reason to believe that what we have seen in the headlines over the last day or two, though very important, isn't what is driving investment decisions."

What does that mean?

It means that you shouldn't pay attention to the news. When you buy shares of a company, you should pay attention to whether that company is actually earning any money.

That's... pretty decent advice, actually.

I suppose. So what stocks should I buy?

Now you're talking! You should, apparently, buy stocks with good earnings.

Which stocks are those?

The article is very clear on that point.

S&P 500 companies' profits are expected to grow 5 percent in the second quarter, according to Thomson Reuters data, down from the 8.4 percent growth forecast at the start of April. Revenue is seen up 3.2 percent.

Basically, this article tells you that you should buy all of the S&P 500.

I'm an individual investor. I can't afford to buy shares in all of the 500 stocks on the S&P 500.

Oh, then this article thinks that you should buy mutual funds.

The whole article boils down to an endorsement of mutual funds?

Yes.

That's kind of useless.

I couldn't agree with you more.